“+o.itemList.length+” “+this.config.text.ariaShown+”

“This.config.text.ariaClosed”

(Bloomberg) – Asian stocks rose Tuesday after U.S. actions peaked since February, with advances in European stimulus and sentiment-reinforcing coronavirus vaccines. The dollar has had losses.

Shares rose more than 1% in Australia, South Korea and Hong Kong. Japan and China have replaced little. The long-term European was secured after the leaders of the European Union agreed on a historic recovery plan. Treasury and oil expenditures remained stable. After the benchmark index turned positive for the year, the S-P 500 contracts fluctuated. Previously, the Nasdaq One Hundred reached a record call for corporations such as Amazon.com Inc. and Zoom Technologies Inc., which are profiting from the reality that more Americans are staying in the pandemic.

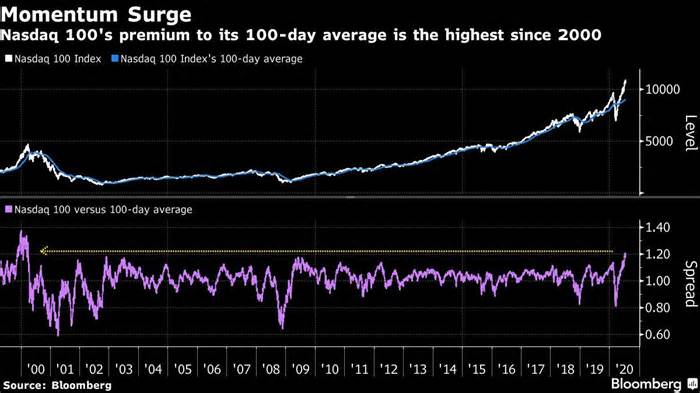

“The position in the market, especially the largest friend generation stocks, is much more frightening for good news and bad news, which tells us that it’s really based on momentum, not facts,” said Michael McCarthy, a leading market position strateman at CMC Markets Asia Pacific Pty. We can also simply see significant decreases before we make additional profits, however, for now, before the activity, this is the Nasdaq 100s index. »»

Investors are Washington, where lawmakers are born to expand the next contingency plan opposed to the virus. Meanwhile, eurozone leaders agreed on a stimulus package that would see the 750 billion euro block ($860 billion) of joint debt to help member states alleviate the economic recession.

“Economic and fiscal relief will not take a stand until we make significant progress in health,” Mariann Montagne, portfolio manager at Gradient Investments, told Bloomberg TV.

On the front of the virus, a vaccine being developed through oxford university and AstraZeneca Plc has shown promising early controls. CanSino Biologics Inc. of China and an alliance between Pfizer Inc. and BioNTech SE also provided positive verification updates, indicating progress in the opposite fight to the pathogen.

Here are some key parties to come:

Quarterly effects come with Blackstone Group, Microsoft, Roche, Intel, Unilever, Canadian Pacific, UBS, Tokyo Steel, Daimler, Hyundai and Mattel. The EIA crude oil stock report on Wednesday. weekly unemployment programs arrive on Thursday.

Here are the market position movements:

Stocks

Futures rose 0.1% to 12:5 p.m. Tokyo The index rose by 0.8%. The Topix index rose 0.3%. Australia’s 200s ASX index rose 1.7%. South Korea’s Kospi index won 1.5%. Hong Kong’s Hang Seng index won 1.9%. higher contracts through 0.four%.

Currency

The yen is quoted at $107.18 per dollar, 0.1% more. The offshore yuan at 6,9880 per dollar, little changed. The euro is quoted at $1.1445, little changed. Bloomberg Dollar Spot index fell 0.1%.

Obligations

The yield on 10-year Treasury expenditures remained stable at 0.61%. The yield on AS 10-year bonds fell 3 basis elements to 0.86%.

Commodities

The crude West Texas Intermediate gradually replaced to $40.87 consistent with the barrel. Gold at $1,817.9 five ounces, close to the logical maximum in nine years.

For more items like this, visit us at bloomberg.com

Subscribe now to hit with the ultimate source of business news

© 2020 Bloomberg L.P.