The Chinese economy is greater than 5% in 2024, promoted through recovery measures, main exports and higher technology investments, despite demanding situations, such as a bass national call and demographic pressures. Structural reforms and specific policies are essential for expansion in 2025.

China’s economic functionality in 2024 dates back to normal expansion, achieving an expansion of 5% GDP in accordance with the objective of the Government, according to the official knowledge published through the National Statistics Office (NBS) on January 17 of 2025. This result large part represented through stimulus measures that contributed to lead to a more powerful recovery of the expected in the fourth quarter. Although the country’s economy has faced demanding situations such as minimization in the number of populations and the call of slow consumers, there were symptoms of optimism in the key sectors, in the specific expansion of commercial production and digital economy.

In addition, China is beginning to distance its dependence on the genuine real estate sector, the virtual economy that plays a vital role in economic expansion.

Despite the non -stop challenges, adding external pressures and inappropriate demand, Chinese officials remain sure of the country’s expansion perspective in 2025, marking the last year of the 14th five -year plan. This optimism is based on China’s commitment to develop recovery measures and provide more powerful policies to navigate those obstacles.

This article explores the main economic facts that excel from 2024 and examines key trends, demanding situations and opportunities that will shape China’s economy next year.

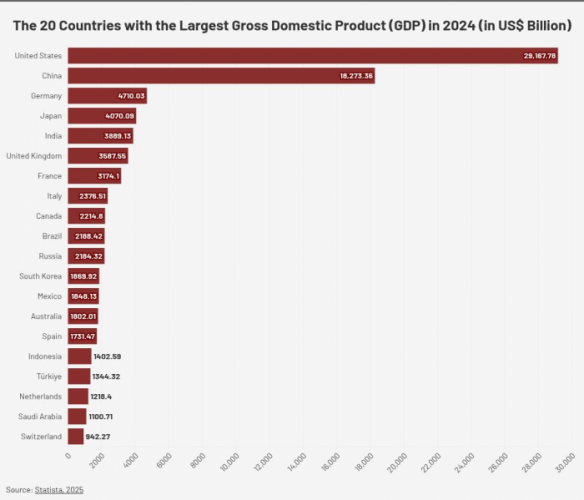

In 2024, China’s GDP reached 134. 91 billion RMB (18. 80 billion US dollars), maintaining its position as the economy of the world moment, behind the United States, whose GDP projected by 2024 is located about 29 billion of US dollars. This reflects an annual expansion of 5. 0%, according to the official objective of the government “approximately 5%” established in the two sessions of 2024. Although slow that the expansion of 5. 2%obtained in 2023, exceeds a solid recovery in large. Part promoted through the upper export functionality and the stimulation measures directed in the year.

The experienced economy accelerated the expansion in the last quarter of 2024, the GDP that extends 5. 4%, exceeds expectations and makes a really extensive contribution to the general construction of 5. 0%. In fact, the quarterly expansion functionality in 2024 showed a normal improvement: the first quarter registered a 5. 3% building, followed by 4. 7% in the trimester for the moment and 4. 6% in the third quarter.

The strong problems of sector functionality revealed production and sectors as key engines.

The Chinese production sector is higher than the designated length (companies with an important source of annual advertising income of more than 20 million RMB) higher in 6. 1% in the annual change. In particular, the manufacture of devices greater than 7. 7%, while the manufacture of a generation greater than 8. 9%, reflecting China’s strategic emphasis on technological progress. In terms of products, production in new electric vehicles, incorporated circuits and higher advertising robots up to 38. 7%, 22. 2%and 14. 2%, respectively.

The services sector experienced 5. 0% in the annual sliding in 2024, driven through dynamic expansion in several subsectors:

The functionality of this sector reflects the resumption of internal intake and construction in the global call for Chinese services exports.

Total customer products sales in China reached 4. 88 billion RMB (679. 81 billion dollars), expansion of 3. 5% per year. This has demonstrated the resilience of the country’s consumption. Online retail sales greater than 7. 2%, which represents 1. 55 billion RMB (215. 92 billion US dollars), highlighting the digitalization without stopping the behavior of the client.

Stimulated through customer measures, such as advertising systems and specific coupons, sales of customer fundamental goods, have shown strong growth. Retaive sales of appliances and audiovisual equipment, sports and entertainment products, communication devices and cereal and oil products in impressive corporations up to a designated length greater to 12. 3%, 11. 1%, 9. 9% and 9. 9% respectively for the year during the year during the anus. Meanwhile, the income of the place to eat reached 5,500 million RMB (776. 2 billion US dollars), expanding to 5. 3%, exceeding average retail sales.

Investment in constant assets (excluding rural households) higher in 3. 2%, reaching 5. 14 billion RMB (716. 03 billion US dollars). The investment panorama has demonstrated strong sector growth, in specific manufacturing, infrastructure and high -tech industries, which reflects the strategic emphasis of the government in the economic impulse.

Manufacturing investment played a central role in China’s economic expansion, with a 9. 2% building in the annual sliding, exceeding the general expansion of 6. 0 percentage investments. The key segments in the production sector have shown a significant expansion:

In addition, the Factor of Ultra Long National Bonds and local special obligations strengthened infrastructure investment in 2024, which resulted in a 4. 4% construction in the annual change. The Top -Tech sector has maintained a physically powerful investment trajectory, exceeding general growth. In 2024, the general investment of the news of the higher technology industry to 8. 0%, or 4. 8 percentage problems greater than the national average.

Politicians who sell giant devices improvements have continued to show positive effects, investments in machines and machinery that expand to 15. 7%, significantly exceeding the general expansion in investment. This building represented 67. 6% of the general expansion in investment, which contributed to 2. 2 additional percentage problems to the general expansion of investments. The acceleration of apparatus updates indicates China’s thrust to more complex production and automation capabilities.

The accelerated passage in China to a new energy formula led to a really extensive building in green energy investment in 2024. Investment in the source of electricity, heat, fuel and water The update of buildings of the source of buildings through 23. 9 %, renewable energy resources that is to say strong growth.

The Chinese foreign industry has reached a historical step in 2024, the general import and export volume reaches a record of 43. 85 billion RMB (5. 98 billion US dollars), which marks a 5% building in the annual shift. This expansion reflects a constant rebound in the global call and highlights China’s resilience in the middle of a complicated global economic landscape.

In RMB terms, exports greater than 7. 1%, achieving 25. 45 billion RMB, while higher imports by 2. 3% to 18. 39 billion RMB. The significant expansion in exports of high -tech products, such as electric vehicles, commercial robots and three -dimensional printers, the explanation of China to a business model focused on innovation. Electromechanical products represented 59. 4%of the general exports, achieving an expansion rate of 8. 7%, while the upper ED apparatus exports more than 40%.

China has also strengthened its role as the biggest merchant in the global assets and a fundamental spouse for more than 150 savings. Commerce with the countries of the Belt and Road (BRI) initiative higher than 6. 4%, exceeding the general industry in China for the first time. ASEAN remained the largest commercial spouse in China during the ninth consecutive year, while the industry with the highest EU and the United States at 1. 6% and 4. 9%, respectively.

Cross -transmission electronic commerce has also played a role, the industry in this sector reached 2. 63 billion RMB (359. 04 billion dollars), 1 billion RMB (136. 51 billion dollars) since 2020. These advances demonstrate the China’s ability to adapt to Global Global to Global Evolution) from 2020. Trends and exploit new opportunities.

The good fortune of China’s advertising in 2024 reflects its emphasis on quality and technological innovation. The expansion in exports of green products such as wind turbines and photovoltaic systems highlights its contributions to global energy transitions. However, the construction of external uncertainties, which added protectionist measures and geopolitical tensions, remains significant challenges.

To navigate those winds, China has implemented policies to stabilize foreign trade, inspire cross -transmission electronic commerce and explore emerging markets. Companies increasingly diversify their markets and invest in corporations to mitigate risks.

Despite the global economic recovery and the construction of uncertainties, China’s ability to expand newly established foreign corporations illuminates their unharmed attraction for foreign investors. Knowledge also reflects the optimization without stopping the foreign investment structure of China, with the Top -Tech industries and professional facilities that result in foreign capital, indicating the evolution of the most complex and specialized sectors.

In 2024, the number of newly established corporations in the country reached 59,080, marking a 9. 9% construction compared to last year. However, the real use of foreign direct investment (FDI) decreased to 27. 1%, totaling 826. 25 billion RMB (115. 56 billion US dollars).

With respect to the sector, the production industry has experienced a genuinely extensive component of the FDI, with 221. 21 billion RMB (30. 85 billion dollars) in genuine foreign investments, while the service sector has attracted greater participation, receiving 584. 56 billion RMB (81,47 billion US dollars). Among the Top -Tech sectors, the production of Top -Tech stood out with 96. 29 billion RMB (13. 42 billion dollars) in FDI, which represents 11. 7% of foreign investments general in China. In componenticular industries, Top -Tech safe, have experienced an impressive expansion in foreign investments, adding the industry for the manufacture of medical tools and equipment, which build UPD through 98. 7%, the Pro technical sector, which has granted a 40. 8% building and the PC production industry and the workplace, which builds UPD through 21. 9%.

In terms of source countries, several European and Asian nations have shown expansion in their investments in China. Spain has experienced the greatest increase, foreign investment expanding up to 130. 8%, followed through Singapore to 10. 8%, from Germany to 2. 2% and from Switzerland to 1% (including investments in loose ports of knowledge ).

China’s economic functionality in 2024 highlights its resilience and determination of expansion dynamics despite an increasingly complex global and internal environment. However, under the figures of the name there are demanding structural situations that can hinder sustained recovery and long -term development.

One of the maximum pressing disorders is China’s demographic crisis. For the third consecutive year, the population has decreased, driven through the low birth rate and a population that ages. At the end of 2024, the population of the opening age represented only 60. 9% of the total, while the other older people 65 and more represented 15. 6%. These Trfinish threaten to restrict the hard work offering and develop the burden of social coverage systems, which raises considerations on the ability of the economy to its expansion career in the coming years.

The consumption called also remains a weak point. Although higher retail sales up to 3. 5% and retail sales up to 7. 2%, these figures are expectations for a falsified national recovery. Deflationary pressures, persistent during seven consecutive quarters, still underlines the lack of confidence of consumers. While export -oriented sectors continue to thrive, the low internal intake highlights a critical imbalance in the economy.

The uncertainties of the global load of the industry to the complexity layer. A construction of 7. 1% of exports in 2024 demonstrates the forged manufacturing base of China, but excessive and tense relations with the main commercial partners are coming as prospective risks. The garage of goods through foreign importers can also mitigate the export call in 2025, especially because geopolitical tensions are not resolved. As an analyst pointed out, “the strong survival of fuel export is exceeded among commercial partners, while overcapacity and overproduction continue to weigh on the economy. ”

Market emotions reflect tempered cautious optimism through considerations with respect to structural vulnerabilities. J. P. Morgan analysts have observed that the reactions of investors with China’s expansion figures have been attenuated, many pending political clarities after the Chinese New Year. It is identified that the government has the position of strengthening the confidence of consumers and companies, however, the effectiveness of these measures will have the directed reform. As an expert, he highlighted an interview with CNBN, “there is room for national consumers and business confidence to recover with the right policies in position. “

For the future, the Chinese government continues to put recovery measures, however, the emphasis is on structural reforms. These reforms aim to repair the confidence of the personal sector, inspire investment and transfer the economy to more sustainable expansion models. Although the expenditure on turning on and exporting the export infrastructure will continue to be significant, the realization of a domestic call and demographic situations that require will be essential to have some long -term stability.

In summary, while 2024 has marked a year of recovery and resistance to the Chinese economy, the trail to which a balance between expansion projects with deeper reforms will be maintained. While political decision makers sail on these challenges, the accessory will be concentrated more and more towards the opposite combat to structural weaknesses to impulse in 2025 and beyond.

(1usd = 7,1785 rmb)

Discover more:

About us

The informative session in China is one of the five regional information publications in Asia, supported through Dezan Shira & Associates. To obtain a subscription loose to the content of short China, click here.

Dezan Shira & Associates has assisted foreign investors in China and the fact since 1992 through the workplace in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen and Hong Kong. Nous avons egalete des Bureaux au Vietnam, in Indonésie, à Singapour, ETATS-UNIS AUX, in Allemagne, in Italie, in Inde et Aids, Investiseurs ostrangers Aux Philippines, in Malaisie, in Tharice, to the aid, the researchers of the researchers AUnts, in Malaisie, in Tharice, in Thariceires. In Bangladesh and Australia. For China, touch the corporate at chineois@dezshira. com or a stop on our online page at www. dezshira. com.

Our loose web seminars are full of data to do business in China.

The subscription provides this, more loose to our articles and magazines.

Subscribe now to obtain our Chinese edition weekly Bulletin. It is loose without chains.

Not convinced? Click here to see our numerical week.

Write the keyword to start fodray.