China’s inventory indexes hit a multi-year low in February. The sell-off was the culmination of months of frustration with a struggling economy and a lack of competitive stimulus policies.

Chinese stocks have been falling since 2021, prompting the government to introduce a wide variety of measures over the past year to revive the market.

China’s most sensible securities regulator, the China Securities Regulatory Commission (CRVS), is unveiling a package of measures to revive the long-suffering stock market, adding proposals to reduce trading costs, buyback rates and inspire long-term investments.

On August 18, 2023, the China Securities Regulatory Commission (CRVS), the country’s top securities regulator, unveiled a package of measures to revive a declining stock market, adding a proposal to reduce trading costs, percentage buybacks, and inspire long-term investments. .

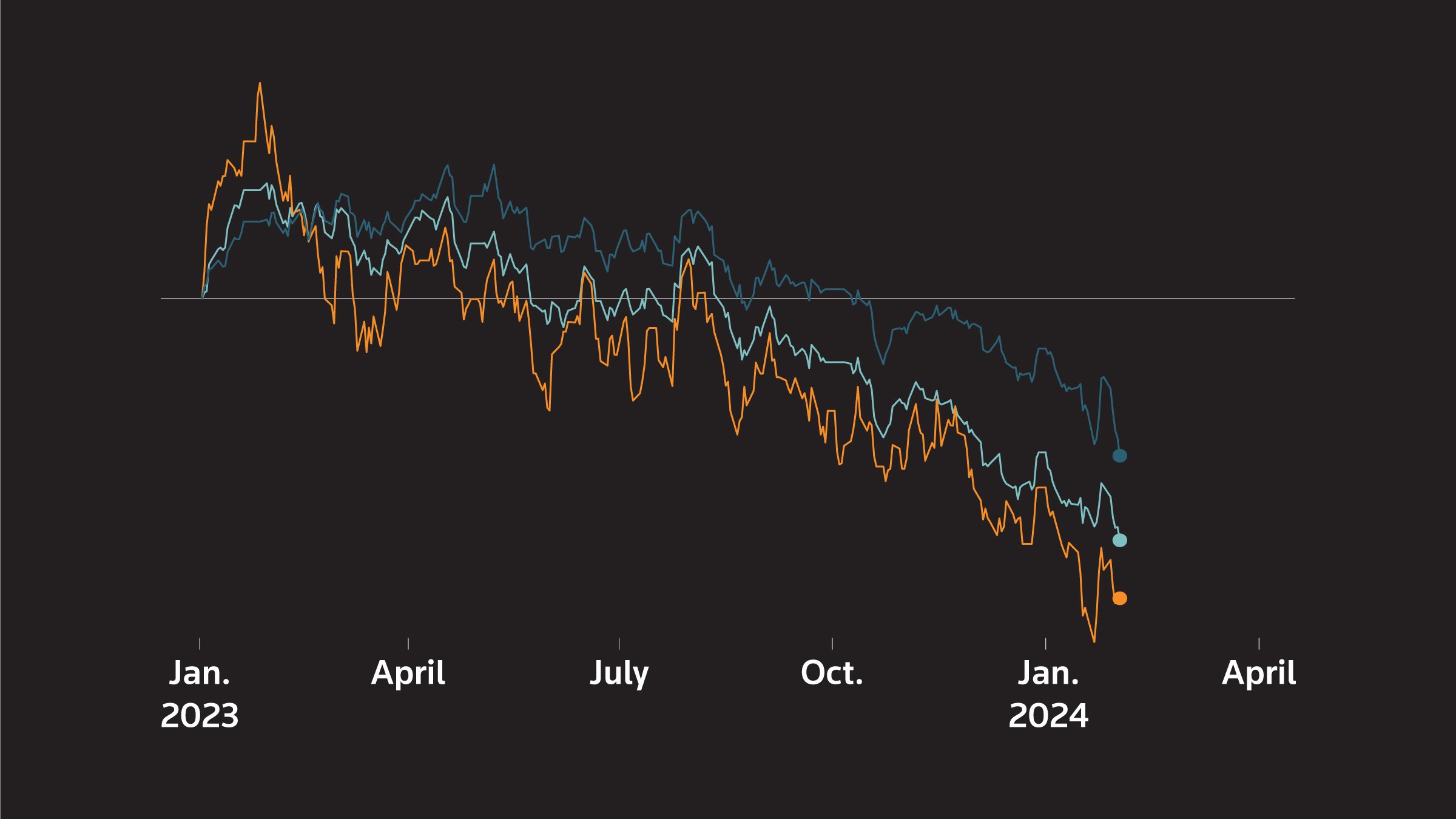

The graph shows other measures taken. On August 28, 2023, China halved the stamp duty on stock market transactions. On September 1, 2023, the CSRC tightened its control over program exchanges. On October 23, 2023, Chinese state-owned fund Central Huijin Investment announced the acquisition of ETFs. On Oct. 30, 2023, dozens of Chinese indexed corporations unveiled plans to buy back and buy shares, possibly responding to Beijing’s call to the market.

On November 27, 2023, the Beijing Stock Exchange banned major shareholders of index companies from selling shares. On December 1, 2023, state-owned China Reform Holdings Corp announced that it had purchased a technology-focused indexed budget. On January 22, 2024, the Chinese company announced that it would inject budget into the capital market. On January 24, 2024, regulators impose further restrictions on stock lending/lending. The central bank is easing policy.

Despite those new measures, the CSI300 falls to its lowest level since 2019.

On February 2, 2024, the CSI300 falls to its lowest level since 2019.

Shanghai’s SE composite hits its lowest level since 2019 intraday.

On February 5, 2024, the Shanghai SE composite reached its lowest level since 2019 on an intraday basis.

China replaces the head of the CSRC with the new head Wu Qing.

On February 7, 2024, China took over as head of the CSRC with Wu Qing.

The chart of three indices (Shanghai SE Composite, CSI300, and Hang Seng China Enterprises Index) from January 2, 2023 to February 26, 2024, with a timeline of key measures taken by the China Securities Regulatory Commission to revive the declining stock market.

After the 2024 Lunar New Year holiday, the CSRC, under the leadership of new chief Wu Qing, held a series of seminars with market participants who proposed a stricter review of quotes and trading habits to revive confidence in the market. Soon after, the CSRC banned the giant quant fund Lingjun Investment from buying and promoting for 3 days after exchanges said they had violated regulations on orderly trading. The CSRC said it would impose increasingly harsh consequences for fraudulent registrations, accounting scams and embezzlement through giant shareholders. The company said it “has a long-term bullish outlook on Chinese stocks and will maintain long positions,” adding that it will examine existing issues in the deals.

China’s strict zero-Covid policies for three years have damaged business confidence and hampered domestic demand, production and investment. Despite an initial rebound in activity after Beijing lifted lockdown measures in early 2023, the economic recovery remains bumpy and uneven. Consumers aren’t spending, costs are falling, and the threat of deflation is hurting corporate profits. More and more corporations are turning to foreign markets to expand.

China’s asset sector, which contributes about a quarter of GDP, is experiencing a prolonged slowdown. New home costs experienced their worst drop in nine years in 2023. A number of primary real estate developers have defaulted on their debts in recent years and are suffering from entire unfinished projects. The liquidation of assets of the giant China Evergrande Group in January this year dealt a severe blow to market confidence.

Competition between the U. S. and China has expanded from generation to industry and finance. Biden’s administration has limited some U. S. investments in China. The gigantic pension and endowment budget of the United States and its allies has also reduced China’s exposure to political risks.

China’s crackdown on the tech sector has wiped out more than $1 trillion from big tech corporations since November 2020. Foreign direct investment fell to a 30-year low in 2023, as corporations shifted production to countries such as India, Mexico and Vietnam. the result of growing geopolitical pressures, knowledge privacy rules, and regulatory repressive measures.

The chart has two bar charts, one showing monthly flows to the China-centric offshore budget from January 2023 to February 21, 2024 and another showing Hong Kong Connect foreign flows from January 2023 to January 2024.

Since 2022, when President Xi Jinping consolidated his power, Beijing has stated that its goals are to achieve high-quality progression and strike a balance between that and security.

These priorities come with reforms of the indebted public sector and local governments, channeling resources towards technological self-sufficiency, measures to boost investment and domestic consumption of electric vehicles, synthetic intelligence, green energy projects, and the fight against monopolies and corruption.

The chart shows China’s annual GDP expansion target with genuine GDP expansion from 2008 to 2023 and the 2024 target that has been officially announced.

The chart is a line chart of China’s policy rates showing three signs (5-year loan rate, 1-year loan rate, and medium-term policy loan rate) of. . .

Private companies, which account for 60% of gross domestic product and 80% of urban jobs in the world’s second-largest economy, are suffering from just three years of COVID-related restrictions, but also from regulatory crackdowns that have targeted sectors ranging from generation to finance to the personal tutorial system.

Many provinces are drowning in debt, while a key source of profit – land sales – has collapsed. The total debt of China’s local government monetary vehicles, or LGFVs, is estimated at more than $9 trillion in 2023, equivalent to part of the country’s economy. The sustained slowdown in the real estate sector has been a major drag on the country’s broader recovery. With falling wages and space costs, customer trust is struggling. Those who can do so move cash overseas. GDP expansion has slowed to 5% from 7-8% a few years ago.

The chart is a domain chart showing China’s overall lending to the non-financial sector as a percentage of GDP per quarter.

The chart is a line chart showing two signs, the consumer price index (CPI) and producer price index (PPI), from January 2020 to January 2024, and how China has either sign in negative territory.

Wary of its cycles beyond strong investment-led expansion and debt accumulation, Beijing has been reluctant to implement competitive stimulus measures to boost market confidence and revive demand.

China approved the issuance of another trillion yuan sovereign bonds and a widening budget deficit in October 2023 for the economy. Beijing has also slashed bank reserves and benchmark lending rates to inspire banks to lend more and spice up home purchases.

The chart is a line chart of China’s quarterly GDP (real values in 2022-2023, forecast for 2024-2025) and inflation (monthly real data from January 2022 to January 2024 and quarterly forecasts from the first quarter of 2024 to the fourth quarter of 2025). ).

Beijing has put forward plans for more affordable housing and for the renovation and infrastructure of urban villages. It has also begun to limit home buyouts and down payment needs in some cities, and banks have been asked to increase their lending to asset developers.

It has issued refinancing bonds to ease the debt burden of local authorities, while limiting the borrowing capacity of certain local government financing vehicles (LGFVs).

Sources

LSEG data streams; LSEG workspace; National Bureau of Statistics (NBS), China; Bank for International Settlements (BIS); LSEG Lipper Data; Hong Kong Stock Exchange and Clearing Limited; International Monetary Fund; Reuters report

Additional Reports from

Gaurav Dogra

Photo by

Aly’s Song

Published by

Vidya Ranganathan, Anand Katakam and Lincoln Feast