The Proportion of Mortgaged Residential Homes in the U. S. A slight increase in the latest quarter, according to new insights released on Thursday, as the ratio of a home’s principal balance to market price rose at a much faster rate across the vast country. Most Southern states: A sign of a decline in housing costs that could prevent homeowners from selling their homes. property.

According to the U. S. Home Value Report,U. S.

A loan is considered underwater or upside down when the home’s equity is greater than its current market price, however, such a loan can be “severely underwater” when the notable loan balance is at least greater than the price of the property. 25%.

While the national percentage was 2. 7%, up from 2. 6%, Kentucky saw the largest increase, with the percentage of notable home balances at least a quarter above asset prices, reaching 8. 3% in the first quarter compared to 6. 3% in the last quarter.

West Virginia followed largely with 5. 4% from 4. 4%, while Oklahoma, Arkansas and Delaware also saw an increase in the percentage of homes that were worth far less than what a homeowner would borrow to acquire them, to 6. 1%, 5. 7% and 2. 7%. % of 4. 4%, 5. 5%, 5. 2% and 2. 3% respectively.

Despite the national increase, Missouri fell from 5. 6% to 4. 5%, making the state’s record in the Midwest region the largest decline; while Mississippi stood out as one of the few Southern states to experience a decline, from 7. 1% to 8% in a region known for its highest concentrations of those mortgage loans.

Receive text alerts of the latest Forbes news: We send SMS alerts to keep you up to date with the most important news of the day. Send “Alerts” to (201) 335-0739 or register here.

The report also shows that 45. 8% of borrowers were considered capital-rich in the first quarter of 2024, meaning they had paid more than part of the property’s market value. The percentage decreased from 46. 1% in the last quarter of 2023. , marking the third consecutive quarterly decline. Compared to the same time last year, the proportion is down from 47. 2 percent, indicating the lowest point in two years, according to the report. The figures show that the U. S. has noticed a decline in the equity-to-wealthy homeowners ratio, indicating that fewer homeowners with U. S. loans would possibly benefit from the promotion of their properties.

Other states where the proportion of homes with notable loans is at least 25% below the market rate is Arizona, which has a rate above 1. 9% to 1. 6%; Hawaii also fell as much as 1. 6% to 1. 7%; while Tennessee fell from 2. 9% to 2. 8%.

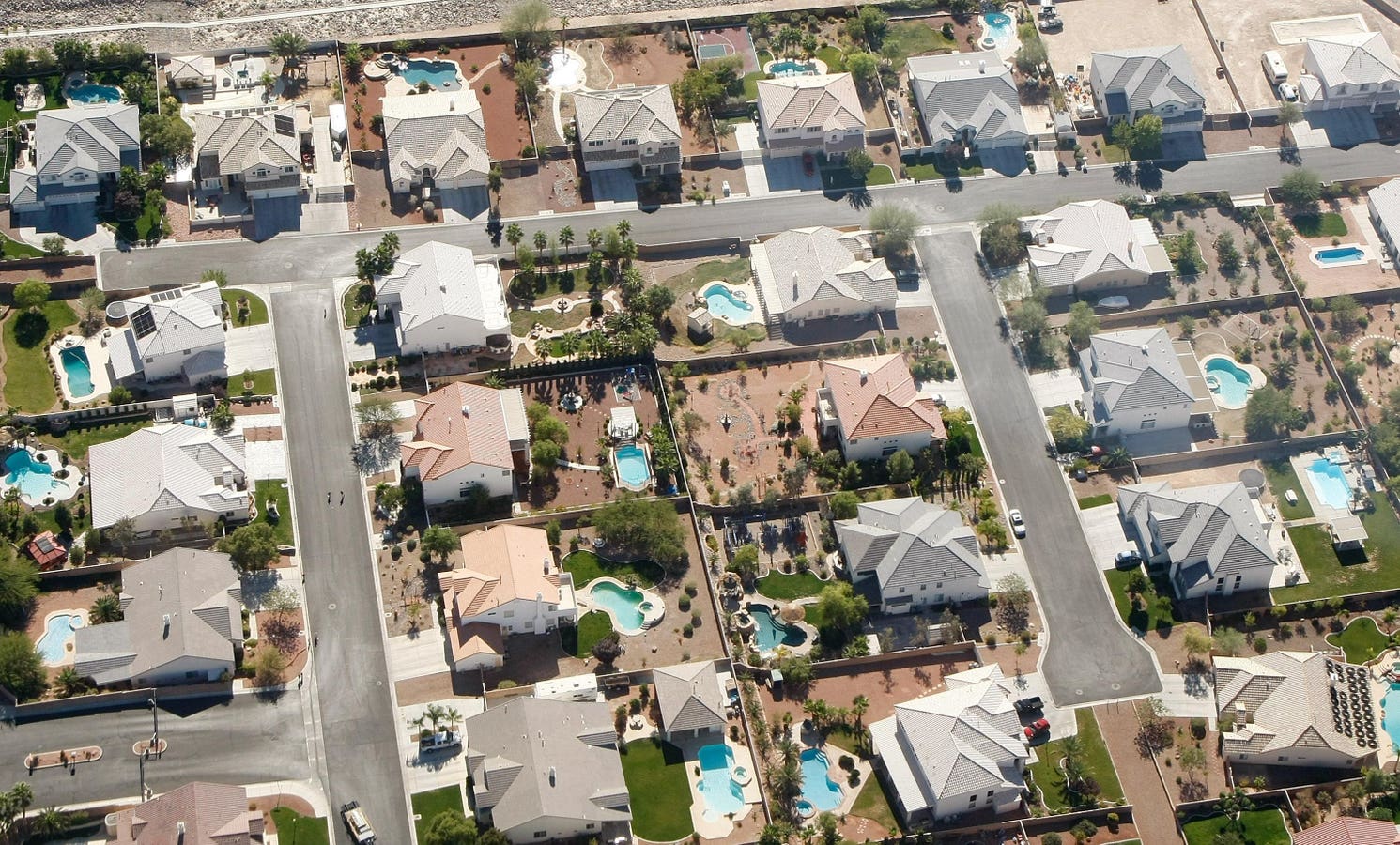

During the pandemic of 2020 and 2021, loan interest rates fell to an all-time low, below 3%. Low rates, which have made it less expensive for Americans to get home loans, have led to an immediate increase in housing costs. However, following a series of rate hikes by the U. S. Federal Reserve aimed at reducing emerging inflation, lending rates rose above 7%, but space costs continued to rise, contributing to an increase in the share of severely sunken homes.

A community. Lots of voices. Create a free account to share your thoughts.

Our network aims to connect other people through open and thoughtful conversations. We need our readers to share their perspectives and exchange ideas and facts in one space.

To do so, please comply with the posting regulations in our site’s terms of use. Below we summarize some of those key regulations. In short, civilians.

Your message will be rejected if we notice that it appears to contain:

User accounts will be blocked if we become aware that users are participating in:

So how can you become a user?

Thank you for reading our Community Standards. Read the full list of publishing regulations discovered in our site’s terms of use.