Today, James Paulsen, a leading investment strata at Leuthold Group, said James Paulsen, a leading investment strata at Leuthold Group, did not repeat the f “generation bubble” of 2000 because they don’t form a real bubble.

The generation sector accounted for most of the increase in the stock market position since the mid-March lows and now accounts for approximately 27% of the capitalization of the SP 500 market position. Several analysts pointed to the expansion of the concentration as a red flag for investors, predicting a correction very similar to that observed when the internet bubble burst.

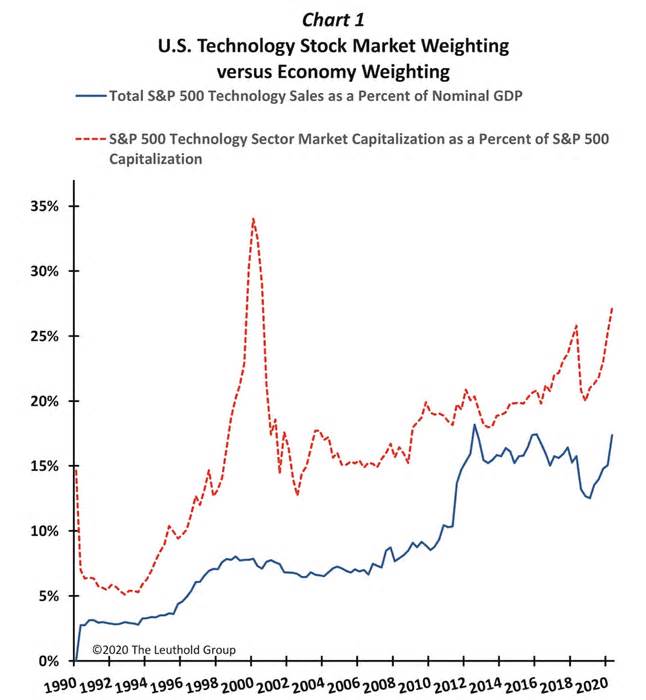

Twenty years ago, sales of generation as a percentage of GDP reached a maximum of 8%, the contribution of companies to the capitalization of the market position of the S-P 500 increased from 34% to 34%. Today, these sales account for 17% of GDP and the percentage of the S-P 500 market position capitalization generation sector is 27%.

Read more: BANK OF AMERICA: Buy those nine shares about to get superior performance in a large apple market environment as they spend so much to create cutting-edge products

“The internet bubble has been bubble, where asset costs have risen much faster than the underlying fundamentals,” Paulsen said.

The Leut Group

Some measures anticipate that technological movements have a wonderful variety of deceptions to operate. Paulsen found that by adjusting the capitalization of the generation sector’s market position for its economic contribution, the shares are valued at fair value. Its valuations collapsed in the early 1990s and from 2012 to 2018, however, the indicator is now just above the previous grades just before the economic crisis. For your weight to move to the degrees of the dotcom era, you’ll need more than duplicate.

Read more: Morgan Stanley presents four imminent dangers that integrate a relentless concentration and push actions into the ‘danger zone’

Technological stocks peaked across all sectors relative to their coronavirus-induced lows, but judging by their direct contribution to economic expansion and relative weighting of market position, investors were concerned about another bubble explosion, Paulsen said.

“Today, in direct comparison to their current basic economic contribution, technological movements are no longer incredibly cheap, but they are also not valued at a price as high as in 2000,” he said.

The result will be catastrophic: a recognized stock exposure says market position valuations rival those of the Great Depression, and warns that a return-to-general pass will be accompanied by a 66% drop

‘We’d buy the fall’: 3 Wall Street weighs on Netflix’s worst-than-expected earnings report

U.S. Jstomer sentiment reverses rebound amid ‘broad resurgence’ of coronavirus, new survey says