Recently, there have been rumors that Bitcoin in China will be “unbanned” – from unsourced tweets to backdoor insights about the Chinese Communist Party’s plans for Bitcoin. Since Hong Kong legalized a spot Bitcoin ETF, these rumors have increased. To understand these rumors, one has to understand the legal status of Bitcoin in China now and what the Bitcoin bans mean – a topic I studied extensively in my book on Bitcoin and China.

First of all, we want to perceive what is happening in China at the moment. After the Hong Kong protests, the lines narrowed between the “One Country, Two Systems” dynamic that promised Hong Kong a different form of government than the mainland. , when it comes to Bitcoin and cryptocurrencies, Hong Kong has another formula and regulators. This has allowed Hong Kong to replace the legality of Bitcoin, and although the new regulations limit OTC counters, the large warehouses of physical currencies where coins can be displayed. and get Tether or Bitcoin, or the other way around, for now they work under an exemption for peer-to-peer substitutes. Hong Kong’s constitution, the Basic Law, enshrines protections for Bitcoin trading to some extent. Therefore, it is unlikely that Hong Kong will ever ban Bitcoin trading as mainland China has done, as long as there is no replacement in the Basic Law.

The Hong Kong spot Bitcoin ETFs are interesting because they involve three large Mainland Chinese asset managers through their HK subsidiaries (ChinaAMC, Harvest, and Bosera. Yet, for now, Mainland Chinese investors are forbidden from investing in Hong Kong’s spot and futures Bitcoin ETFs – though the issuers have sometimes mentioned “offshore” interest from the Mainland.

This is because Bitcoin is tightly regulated in Mainland China. People have been arrested for trading Tether by itself and using virtual currencies (in conjunction with other crimes). Bitcoin mining is banned, with Bitcoin mining conferences moving out of Mainland China and significant amounts of hashing/mining power. Bitcoin exchanges no longer serve Yuan trade for cryptocurrencies, and they generally ban Chinese IP addresses from accessing their services – and many overseas exchanges have their IP addresses blocked by the Great Firewall.

The Bitcoin bans in China really are a set of regulatory notices that escalate year by year, involving law enforcement in 2021. At the same time, Chinese courts have generally held that Bitcoin is property protected by the law (and likely will continue to do so—leading to more headlines that China is reconsidering Bitcoin each time).

There have been headlines about China, such as the Hong Kong professor who thought banning Bitcoin mining was a mistake because it increased US tax revenue. It is entirely imaginable that China will examine Bitcoin as it did with “blockchain” and Web3, and that the headlines will continue in that direction, especially with the prospect of a pro-Bitcoin Trump administration.

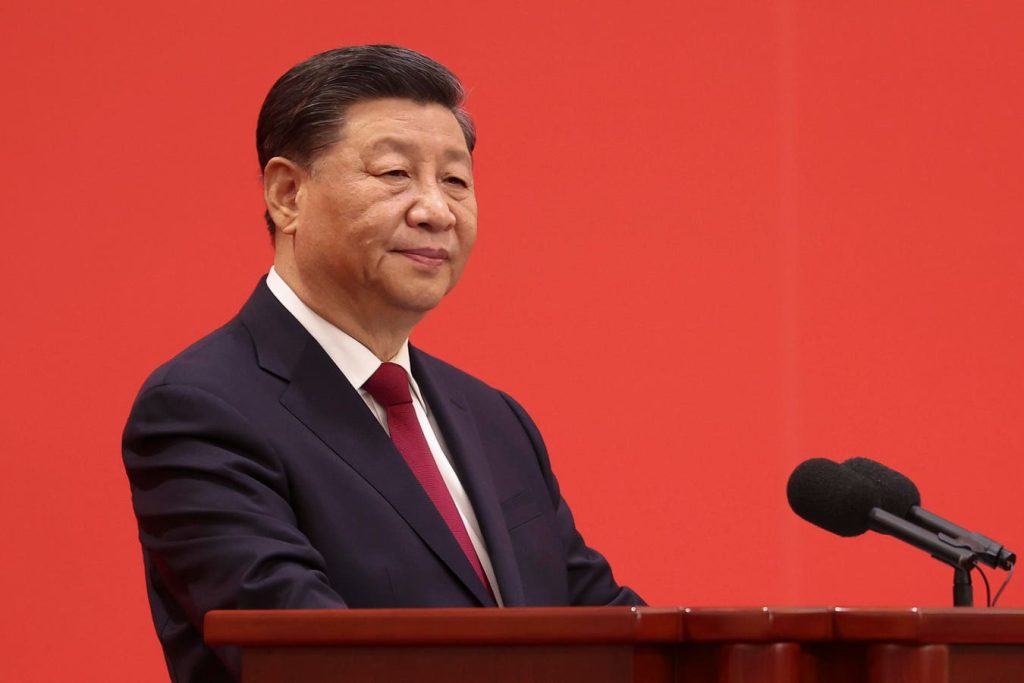

Probably very little maximum. Most technical agencies that prohibit/regulate Bitcoin, such as the People’s Bank of China and SAFE, which administers capital controls, follow a political trajectory that spans decades. While it is true that in the afterlife Xi Jinping’s words have led to an acceleration and policy replacements, the mining bans were imposed through Liu He, one of Xi Jinping’s most trusted economic advisors. Given that Xi Jinping will likely be in place until at least 2029, he would like to make a radical turn to replace his well-established political trajectory, despite the deep ideological struggle against Bitcoin within the Chinese Communist Party.

China was one of the first countries to recognize Bitcoin’s threat to its model, from tight capital controls to control of energy. China’s path on the Digital Yuan isn’t so surprising when one considers that the chief tension in Chinese politics has been the amount of control the Party exerts over the economy. The policy path of spreading central bank digital currencies and displacing Bitcoin is unlikely to reverse – meaning that any headlines that come out of China are not likely to indicate policy shifts – though they may be favorable to price sentiment as headlines that reflect China’s continued acceptance of Bitcoin as property, experiments in Hong Kong with the spot Bitcoin ETF, and considered study of the US President, no matter what Party they’re in – a long-standing and top priority of the Chinese party-state.

A community. Many voices. Create a free account to share your thoughts.

Our network aims to connect others through open and thoughtful conversations. We need our readers to share their perspectives and exchange concepts and facts in one space.

To do this, please comply with the posting regulations in our site’s terms of use. Below we summarize some of those key regulations. In short, civilized.

Your post will be rejected if we notice that it seems to contain:

User accounts will be locked if we become aware that users are engaging in:

So, how can you be a power user?

Thank you for reading our Community Guidelines. Please read the full list of posting regulations discovered in our site’s Terms of Use.